Product

Benchmark your ESG strategy with AI-powered Recomentor.

Stop struggling with fragmented reports and inconsistent data. Recomentor analyzes sustainability disclosures across major frameworks (CSRD, GRI, SASB, and more), identifies performance gaps, and benchmarks your company against top industry peers — so you can see exactly where to improve and lead.

The demands to meet sustainability criteria and align with regulatory requirements are increasingly at the forefront of private and public entity agendas. Consequently, the need for AI-powered tools has risen to increase transparency and fill the data gaps. Through large language models (LLMs), the Recomentor platform helps organisations automatically extract data from company activities and see which areas need to be improved in order to meet regulatory requirements.

Highlighted Recomentor Features

Access an automated report that analyses your compliance for you

Once a compliance check has been initiated, the Recomentor platform creates a downloadable report that is packed with actionable insights. Spend less time deciphering content by downloading a report with a detailed analysis that is based on the frameworks you’ve selected.

Identify key relationships and topics relevant to your selected focus area. For example, if you’re exploring “Climate Change,” Recomentor connects the dots between risks, opportunities, and stakeholder impacts across the value chain

Recomentor analyses some – but certainly not all – of the following topics: Environmental (species impacts, resource dependencies, and ecosystem health), Social (workplace policies, safety systems, and ethical work practices), and Governance (product end-of-life management and supply chain processes).

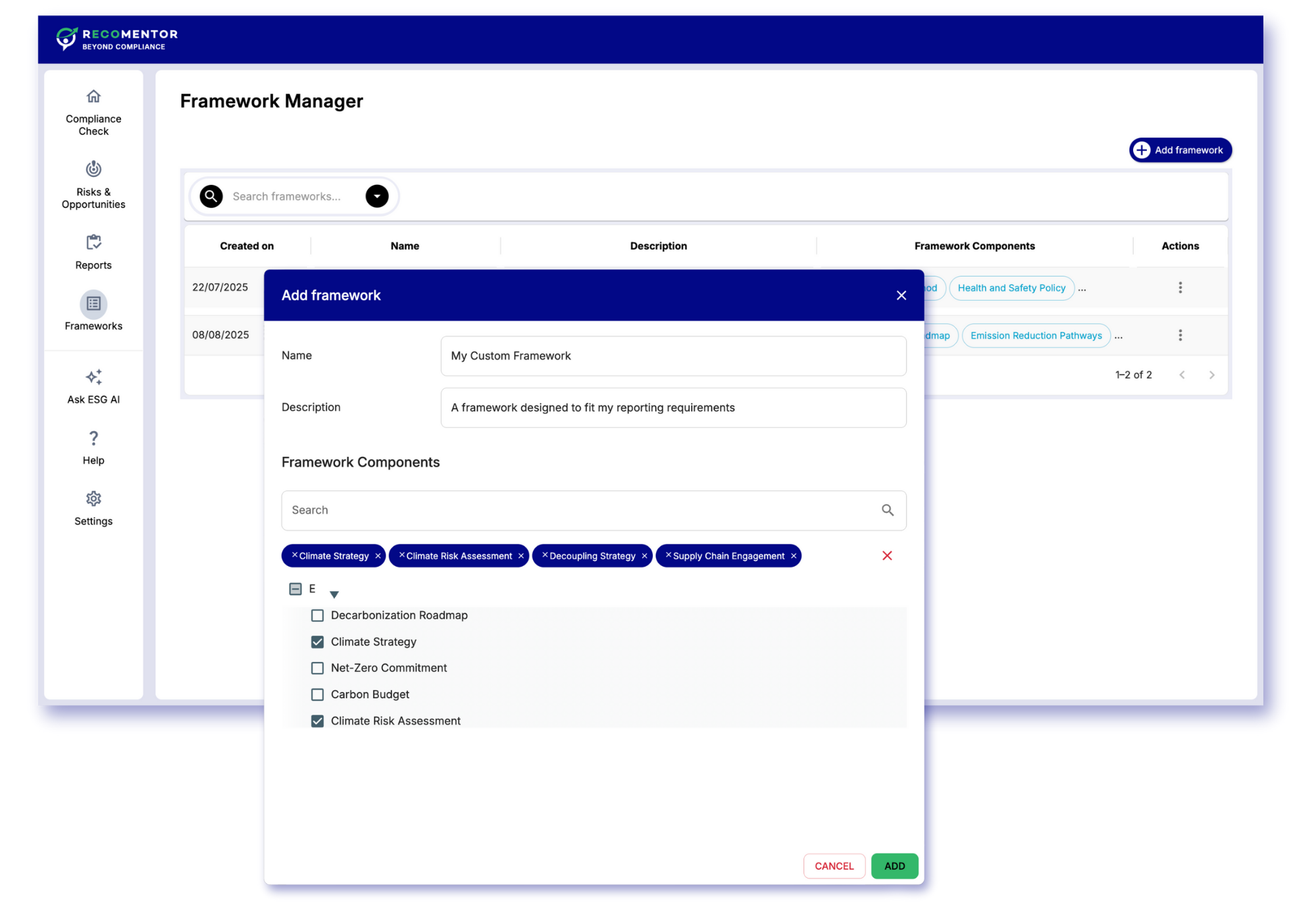

The most important ESG frameworks at your fingertips

ESG is a dizzying world of standards, policies, statistics, governing bodies, etc. Based on an extensive ESG knowledge model, Recomentor will give you the possibility to select a complete framework or create a blended view to align with the latest demands of regulators as well as those of company decision makers.

Easily select frameworks/standards that are integrated in the platform including (but not limited to) CSRD, ESRS, SDGs, EU Taxonomy etc.

Build a customised dashboard of standards that are most relevant to your business

Choose specific topics from a framework based on internal priorities

Monitor how you are reporting on topics and sub-topics

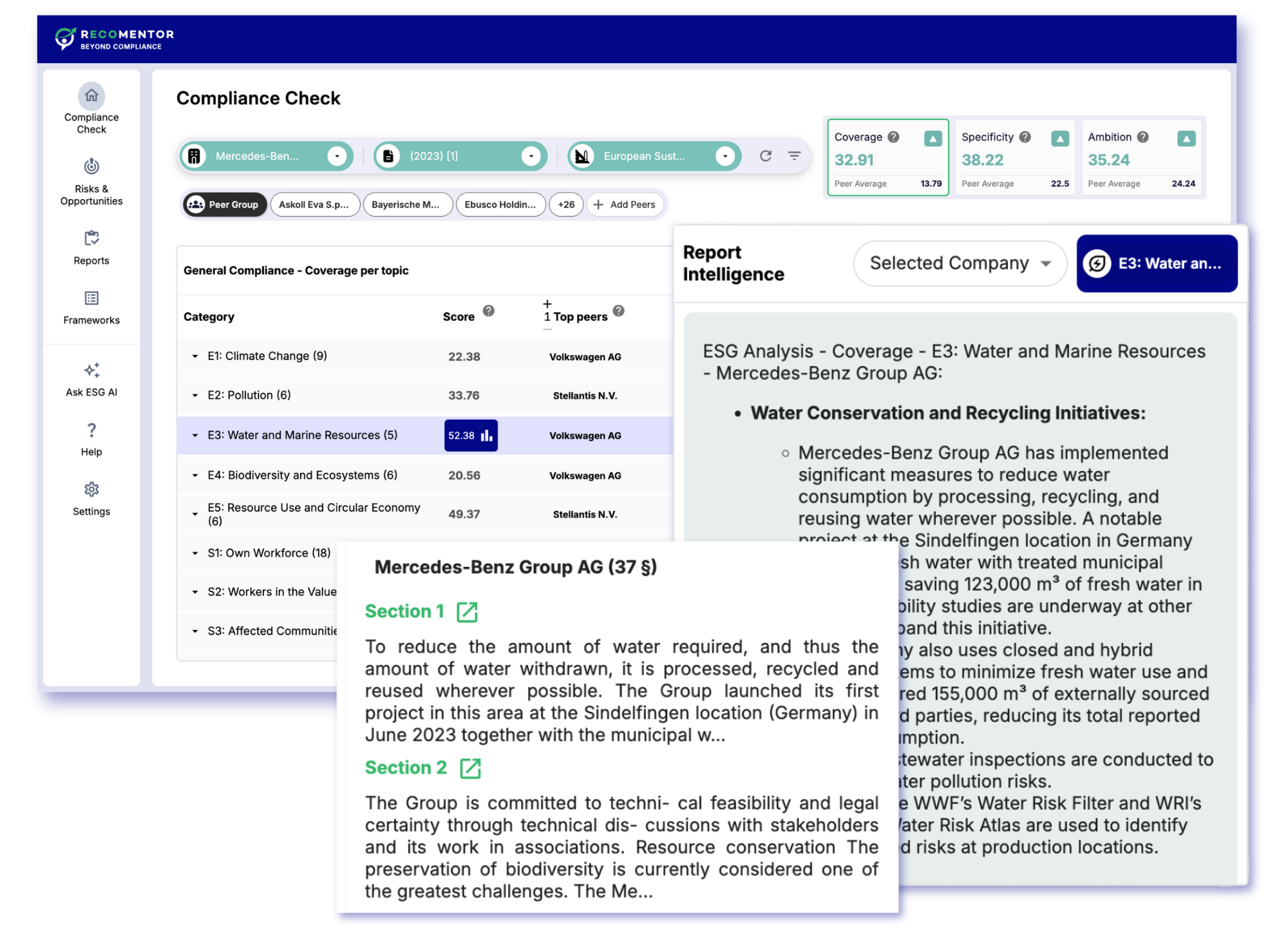

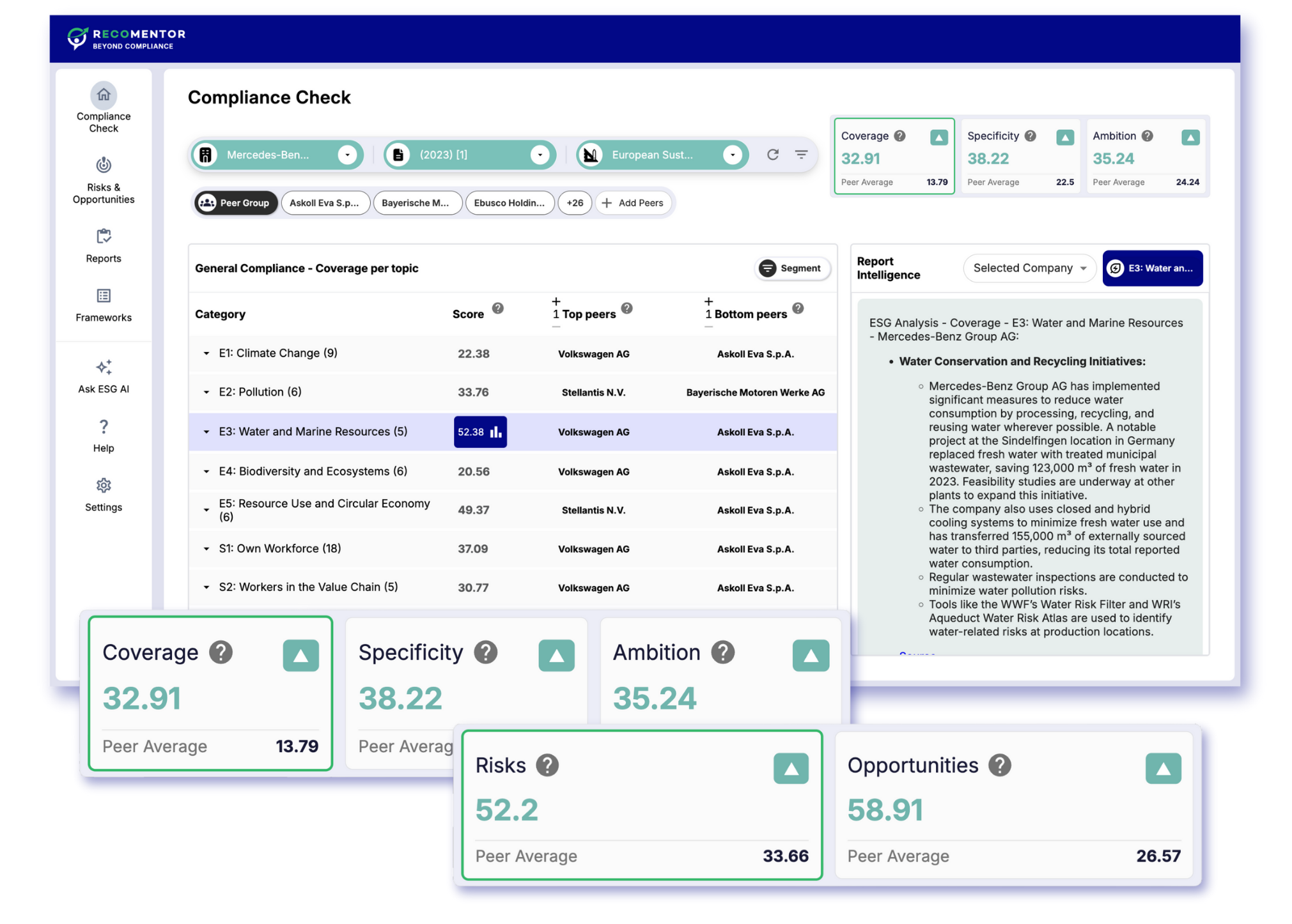

Target reporting gaps based on three quantitative indicators (4 dimensions)

Recomentor considers 4 dimensions when surveying a company’s compliance. Through these indicators, the Recomentor platform is able to run its analysis and provide you with the most thorough insights.

Specificity Indicator: How detailed is your report? Do you simply mention “biodiversity” as a main topic or do you go into deeper details about soil diversity?

Ambition Indicator: How central are these topics to your ESG strategy? How often are they mentioned and linked to risks/opportunities?

Coverage Indicator: Do you focus mainly on your direct operations, or also on the impact of your supply chain and external activities?

Risk and Opportunity Indicator: Does your report mention specific keywords that highlight potential risks that you’re unaware of? Are there opportunities you’re not capitalising on?

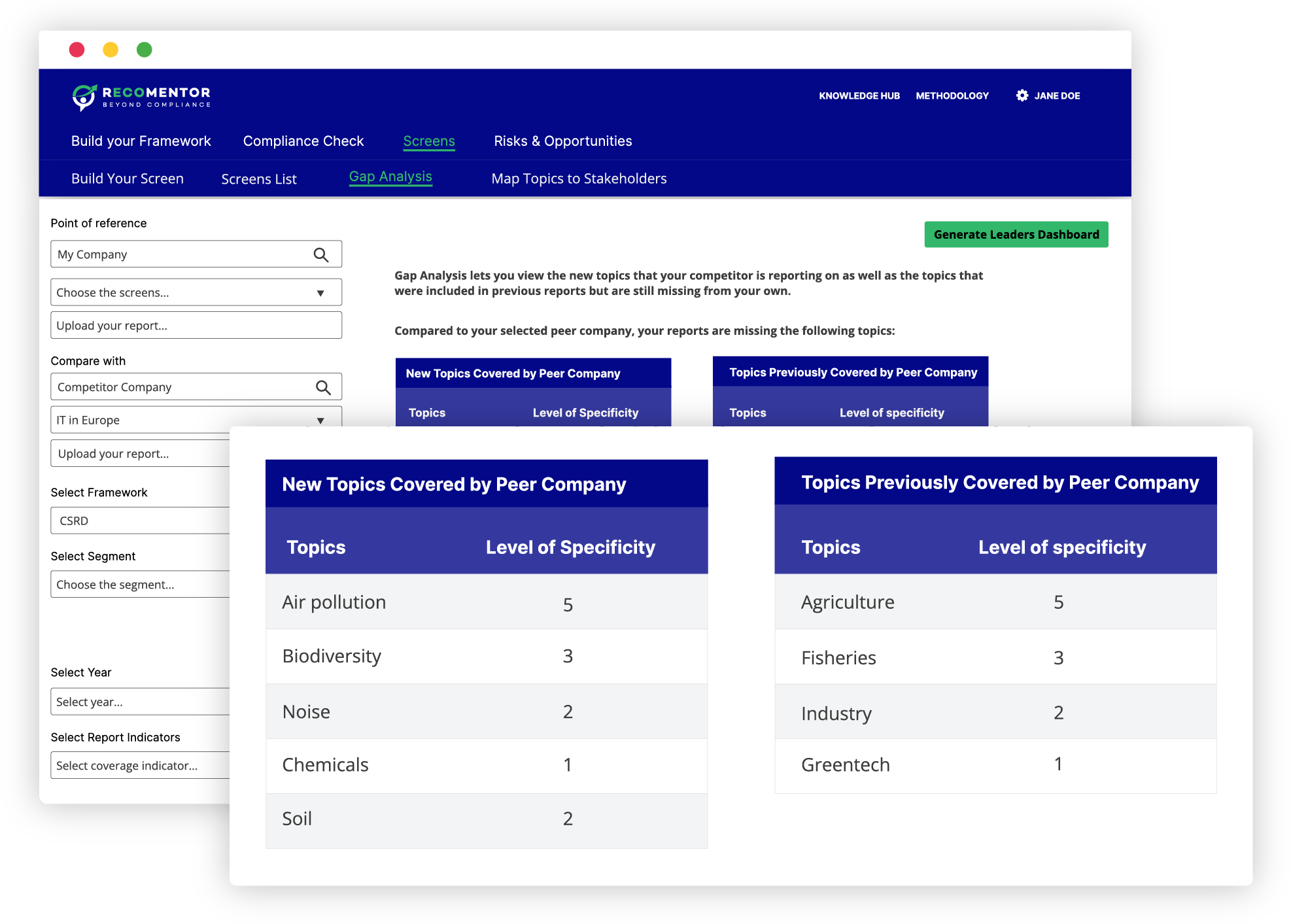

Define your strategy based on peer activities

Our benchmarking tool provides verified data-driven insights that you can leverage for your own strategy. Use patterns in the peer data to know which ESG initiatives you should prioritise in relation to what has the most potential impact.

Get an overview of peer companies by filtering your target peers list based on specific criteria, e.g. company size, location, financials

See which topics similar companies are reporting on in order to align your strategy in the right direction

Become up-to-date with the latest regulatory demands by seeing which new trends are appearing in industry sustainability reports

Understand which financial indicators you should watch for based on specific risks

Get an initial indication of where your gaps might be compared to competitors

See whether you are reporting above or below the median level (compared to peers) on a specific topic

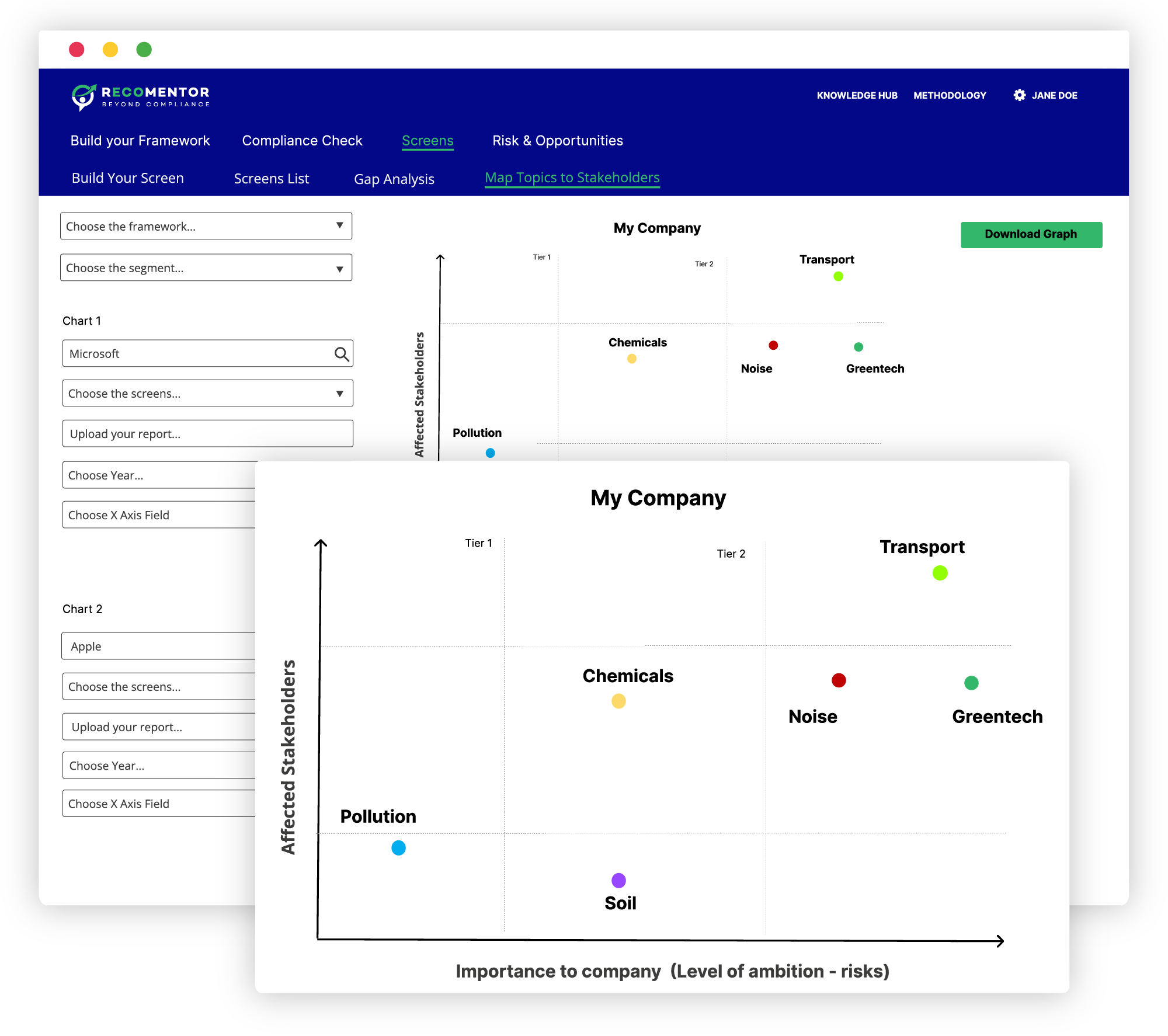

Build policies for specific stakeholders

Recomentor helps you align more closely with industry standards and stakeholder expectations.

Generate a graph that identifies which specific topics affect the most amount of stakeholders, e.g. if pollution risk is above the trendline, it has a greater negative impact

Compare against a peer company to see which risks have affected them and learn to not repeat those same mistakes

Download a detailed report and table of the results for further analysis

Understand which specific stakeholders to target to optimise your strategy, enhance your reputation, and avoid specific risks

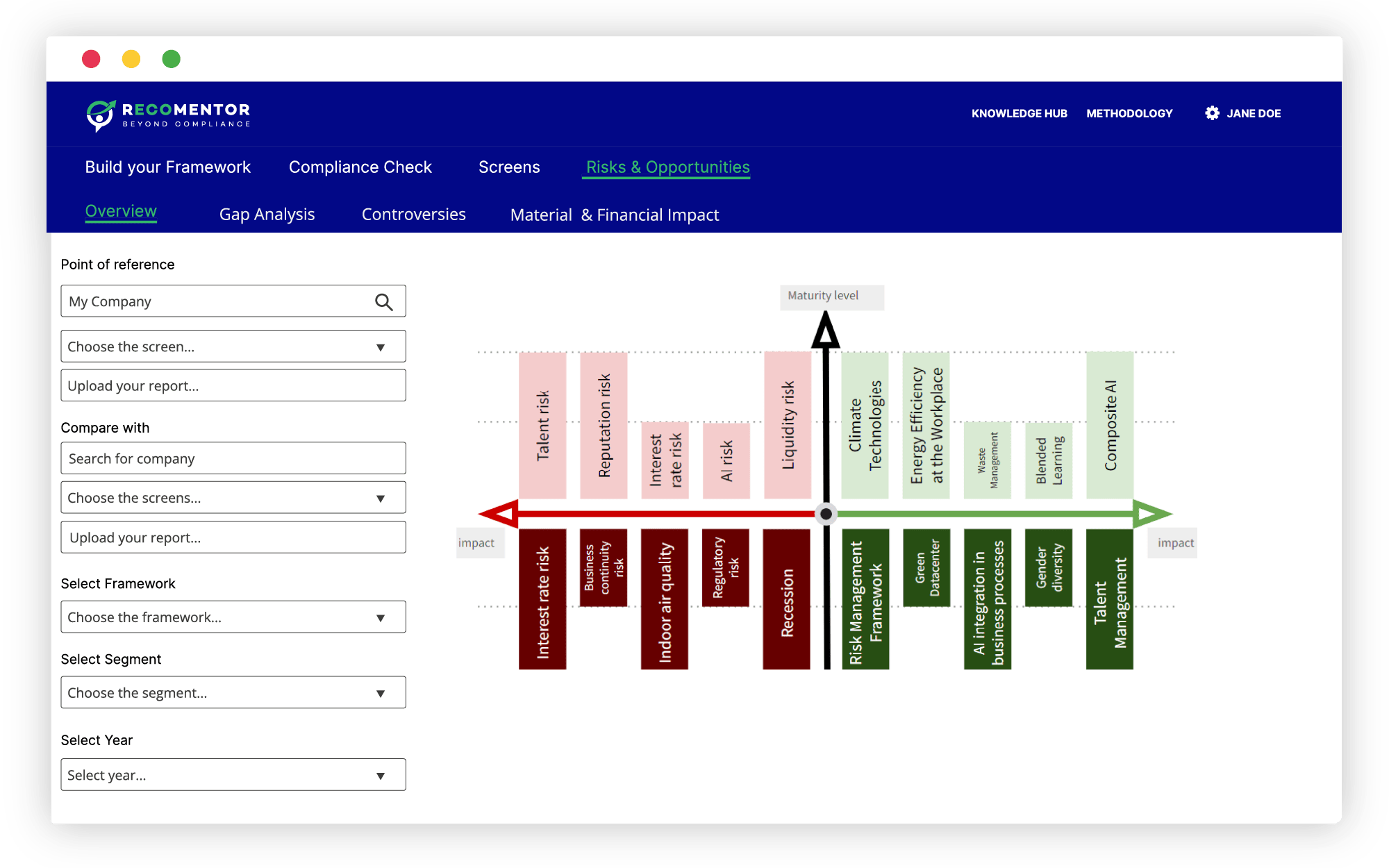

Protect yourself from unintended consequences of your ESG strategy by revealing hidden data connections

The Recomentor platform provides users with a view of risks and opportunities from two angles: those that are already considered and included in their ESG strategy and those that are overlooked but are included in the strategy of other companies. Recomentor runs a comparative analysis between different entities specified by the user so that you can understand which risks to tackle.

View a detailed risk graph to learn the cascading effects of a risk related to a sustainability topic

Download a table of cascading risks and map them to financial indicators

Identify gaps in your strategy based on keywords that are missing from your documents; Recomentor’s text mining capabilities will alert you to important topics that you should pay attention to because they haven’t been detected in your reports

Become aware of which operational activities have the potential to lead to controversies based on tendencies within the data

Get the full scope of potential consequences with controversies that are mapped to litigation topics. Litigation data is extracted from databases on an international scale and regional scales (US and EU coverage)

Use cases that the Recomentor platform is designed to support

01

Double materiality assessment made easy

02

Comply with the CSRD and other regulations

Built on a comprehensive ESG Knowledge Model.

The ESG corporate landscape is made up of a lot of regulations that come from fragmented sources. So that you don’t have to look for all these regulations yourself, we’ve put it altogether in one Recomentor knowledge model.

Quick facts about the knowledge model:

Standard-based (SKOS, RDF, OWL)

Uses taxonomy, ontology, and knowledge graph elements

Provides basis for highly precise, and scalable text mining

Covers SDGs, GRI, CSRD, EU Taxonomy and much more

concepts with 8600 comprehensive definitions

terms (including synonyms and acronyms)

relations between concepts (hierarchical and non-hierarchical)

custom ESG relations

mappings to Wikidata and DBpedia

Unlock your ESG potential – Book a demo today.

Request a personalized demo to explore the full potential of our offerings and see how they can be tailored to meet your specific needs.