Solutions

Save Time Reporting on CSRD

Easily comply with the vast regulatory landscape of ESG

The latest regulatory developments in the European Union, including the adoption of the Corporate Sustainability Reporting Directive (CSRD) as well as the Corporate Sustainability Due Diligence Directive (CSDDD) will affect many companies operating in these countries – regardless of whether or not they are headquartered there.

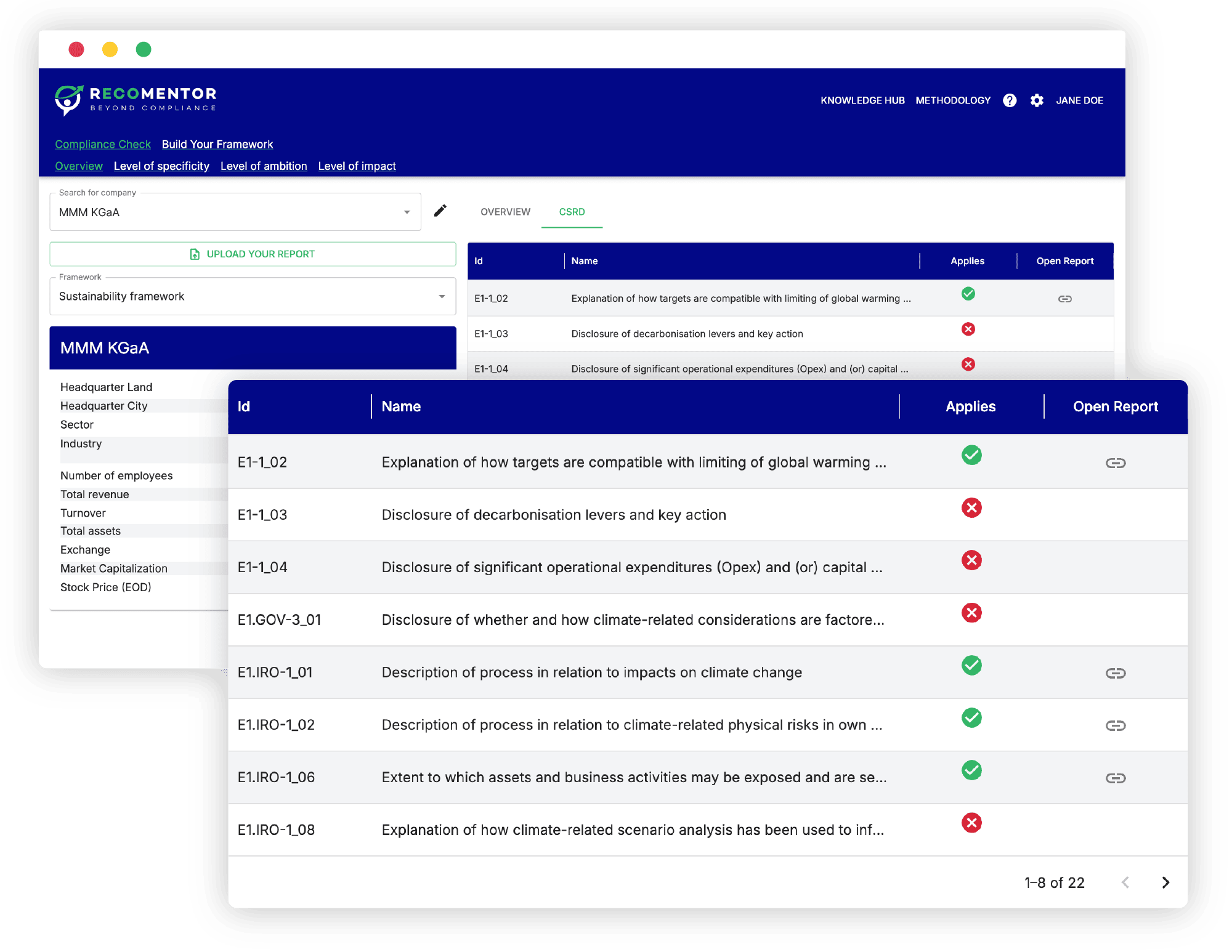

Recomentor helps ensure that you are no longer intimidated by all these regulations by incorporating all relevant frameworks in one tool. Using large language models (LLMs), Recomentor helps organisations automatically extract data from company activities and see which areas need to be improved in order to meet regulatory requirements.

How Recomentor keeps you on top of the highest regulatory standards

01

Streamlined compliance that is tailored to your needs

Recomentor is built on a comprehensive ESG knowledge model that aligns with the European Sustainability Reporting Standards (ESRS). Whether you need to comply with the CSRD’s extensive disclosure requirements or the CSDDD’s due diligence obligations, Recomentor provides:

Customise your reporting framework: Users can filter data points and ESG topics or build tailored lists of companies for comparison. Your reports will meet all regulatory demands while still being focused on your business strategy.

Integrate seamlessly with your existing systems: Choose between SaaS or a customizable data product integrated with third-party tools via API. The software also offers data storage on Microsoft Azure or AWS, ensuring secure and efficient data handling.

02

Advanced risk management and due diligence

The CSDDD sets out the responsibility for companies to identify and address human rights and environmental risks across their operations and supply chains. Recomentor goes beyond compliance by helping businesses take proactive steps toward risk management.

Automate gap analysis: Through intelligent text mining capabilities, Recomentor helps identify and assess risks within your operations and supply chains, helping to facilitate the development of due diligence plans.

Get actionable insights: Access detailed reporting on both direct and indirect risks related to ESG. This allows you to comply with CSRD and implement effective mitigation strategies so as to avoid risks that were previously unseen.

03

Automate your CSRD reporting with LLMs

Repurpose valuable content: Reports that are stored in Recomentor, can then be found easily using Recomentor’s semantic search capabilities. Other users can easily access important documents and reuse the content for other activities and decision making.

Other things you’ll enjoy about Recomentor

Easy to use:

Recomentor has a user friendly interface and requires only a few clicks of your mouse to begin your double materiality assessment.

Data visualisations:

Not only does Recomentor automate your reporting, it also provides new insights with graphs and charts.

All your frameworks in one tool:

Recomentor incorporates all relevant ESG frameworks and allows you to also import other data that is relevant to your business.

Built on AI and LLMs:

With Recomentor, you’ll be using cutting-edge technology that is enhanced by knowledge graphs.

What are the main regulations?

Though ESG reporting is based on a number of frameworks, some of the main standards that have come into effect in the European Union are CSRD, CSDDD, SFRD, and the EU Taxonomy.

Corporate Sustainability Reporting Directive (CSRD): The EU’s directive that mandates ESG compliance for companies starting in 2024.

Corporate Sustainability Due Diligence Directive (CSDDD): Requires companies to report on their operations and supply chains.

Sustainable Finance DIsclosure Regulation (SFDR): Since 2021, its goal is to improve transparency and standardisation of ESG disclosures for financial products and services.

EU Taxonomy: Determines the conditions for an economic activity to qualify as environmentally sustainable through classification of activities.

Do these regulations apply to my company? Act quickly to avoid penalties.

Though these regulations will affect all company sizes further down the line, the big regulatory frameworks such as CSRD reporting are already placing urgency on large companies.

You need Recomentor if the following two out of three criteria applies to your EU/EEA-based company:

- Your net turnover is at least 40 million euros

- Your assets are at least 20 million euros

- You have more than 250 employees on average

If your company is headquartered outside the EU, you are required to comply if you have at least one subsidiary in the EU and generate a net revenue over 150 million euros within this territory.

Regardless of where you are located, Recomentor and its data products cover regulatory frameworks from across the globe. Our software grows with your needs, offering scalable solutions from small subsidiaries to multinational operations – simplifying the compliance and reporting process.

Check out these other resources to learn more about Recomentor.

Portfolio Knowledge Discovery at the Green Climate Fund

Watch this webinar featuring our customer to learn how they use semantic technologies to provide financial assistance for climate change adapatation.

Conversational AI Assistant

Play around with our ESG Conversational AI assistant to get a taste of how AI can help your company.

Mitigating ESG Risk with Reliable Data and AI

This roundtable combines experts in sustainability, finance, and technology who will speak about how to roll out successful sustainability strategies and the advantages of an AI-driven approach.

Unlock your ESG potential – Book a demo today.

Request a personalized demo to explore the full potential of our offerings and see how they can be tailored to meet your specific needs.